How to Organize Invoices and Streamline Your Workflow

Learn how to organize invoices with our guide. We cover digital systems, automation tools, and workflows to help you manage records effortlessly and accurately.

Let's be honest, that feeling of dread when you have to find that one invoice from six months ago is all too real. You're digging through overflowing folders, searching countless email threads, and praying you don't miss a payment deadline. If that sounds familiar, you're not alone. The secret to escaping this paper-and-digital-clutter nightmare isn't some complicated, expensive software - it's building a straightforward, modern system that finally gets your invoices in order.

Why Getting Your Invoices Under Control Is a Game-Changer

It’s one thing to tidy up a messy desk, but it’s another thing entirely to build a rock-solid process that actually saves you time and makes tax season a breeze. The hard truth is that so many businesses, from solo operations to growing teams, are still wrestling with clunky, manual methods for handling their bills. This isn't just a minor headache; it's a huge time and money sink.

The data really brings this issue to life. An eye-opening 68% of businesses still type invoice details by hand into their accounting systems. Less than a third have brought any real automation into the mix. This old-school approach doesn't just add hours of busywork to your week - it carries a steep price, costing an average of $15 just to process a single invoice. You can dig into more surprising accounts payable statistics to see just how widespread this problem is.

This guide is your step-by-step plan for leaving those frustrating, outdated habits in the rearview mirror. We're going to set up a system that gives you back your time, slashes your stress levels, and provides a crystal-clear picture of your finances.

The Ground Rules for Smarter Invoice Management

Before we jump into the nitty-gritty of tools and workflows, let's lay down a few core principles. These are the non-negotiables that will make any organizational system you choose truly effective. Think of them as the foundation you build everything else on.

- •

Digitize Everything, No Exceptions: The most important first step is getting all your invoices into a digital format. Any paper bill that comes in should be scanned the moment you receive it. This instantly creates a single, searchable library and gets rid of the risk of a crucial document getting lost or damaged.

- •

One Place for Everything: Whether an invoice arrives as an email attachment, a paper receipt you just scanned, or a PDF you downloaded from a portal, it needs to go to one central hub. This could be a designated cloud storage folder or a dedicated tool like Tailride, but the main goal is to stop invoices from living scattered across different email accounts, desktops, and download folders.

- •

Consistency is King: A system is only as good as your commitment to it. This means you need to decide on a set of rules and stick to them. How will you name your files? What will your folder structure look like? What tags will you use? Consistency is what makes the system work on autopilot.

A great invoice system isn't about having the fanciest software; it's about having a simple, repeatable process that everyone on your team can follow without thinking twice. The goal is to make organization the path of least resistance.

Now that we've covered the fundamentals, you're ready to start building a system that turns invoice management from a dreaded chore into a genuine business advantage. Let's get to it.

Here’s a quick rundown of the foundational pillars for a better invoice system that you can start putting into practice today.

Quick Wins for Better Invoice Organization

| Action | Why It Matters |

|---|---|

| Digitize All Invoices on Arrival | Creates a searchable, secure, single source of truth. No more lost paper. |

| Create a Central Invoice Hub | Stops documents from scattering across emails and desktops, saving you time. |

| Set Clear Naming & Filing Rules | Consistency makes your system predictable and easy for anyone to use. |

Sticking to these simple actions will fundamentally change how you handle your finances, making the entire process smoother and far less stressful.

Designing Your Digital Filing System

It's time. Let's finally say goodbye to the shoeboxes overflowing with receipts and the desktop cluttered with randomly named PDFs. A solid digital filing system is the absolute backbone of modern invoice organization. This isn't just about being tidy - it's about building a reliable, audit-proof system that lets you pull up any invoice in seconds.

The first decision on your plate is where to store everything. You could start with basic cloud storage like Google Drive or Dropbox, and honestly, they're great for getting all your files into one central place. But as your business grows, you'll start to feel their limitations pretty quickly.

That's where dedicated accounting software or platforms like Tailride really shine. They don't just hold your files; they integrate storage with action. These tools read the invoices, help categorize them, and get them ready for payment and reconciliation. For any business starting to feel buried in paperwork, a smart approach to Small Business Document Management is a true game-changer.

Build a Logical Folder Structure

A chaotic folder system is really just a digital shoebox. The trick is to create a clear hierarchy that makes sense the moment you look at it. After years of experimenting, I've found a simple, scalable structure that works for almost everyone.

Start with one main folder - let's call it "Business Invoices." Inside that, create subfolders for each calendar year.

- •

Business Invoices/- •

2024/ - •

2023/ - •

2022/

- •

Now, here’s the pro tip. Within each year, create folders based on payment status. This one small tweak is a lifesaver for managing cash flow because it gives you an immediate visual cue of what needs your attention.

- •

2024/- •

01_Pending_Approval/ - •

02_Approved_for_Payment/ - •

03_Paid/

- •

The workflow is simple. Once an invoice is paid, you just drag it from "Pending" or "Approved" into the "Paid" folder. If you want to get even more organized, you can create subfolders for each vendor inside the "Paid" folder. This makes tracking down a specific past invoice incredibly fast.

Create Consistent File Naming Rules

Your folder structure gets you halfway there. A consistent file naming convention is what brings it all home. When you get this right, your files become instantly searchable before you even click on them.

A formula that has never failed me is: Date_Vendor_InvoiceID.pdf.

Let’s take a real-world example. Say you get an invoice from "Creative Solutions" with an ID of #CS-843 on November 15, 2024. You'd save it as:

2024-11-15_CreativeSolutions_CS843.pdf

This system ensures that even if you have thousands of files, a quick search for "CreativeSolutions" or "2024-11" will pull up exactly what you need. It completely removes the guesswork.

When you combine this naming rule with your logical folder structure, you've created a powerful, self-organizing system. It’s a simple change, but believe me, it pays huge dividends in time saved and stress eliminated, especially when tax season or an audit rolls around.

Choosing Your Invoice Automation Tools

Let's be honest: manual data entry is a soul-crushing time sink, and it’s a breeding ground for expensive mistakes. If you're still hunched over your keyboard, painstakingly typing out invoice details, it’s time to find a better way. Technology is your best weapon here, and it’s the key to building an efficient system for organizing your invoices.

This is where invoice automation tools enter the picture. They’re designed to swap out that manual grunt work for smart, automated workflows. The magic behind many of these tools is Optical Character Recognition (OCR). Think of it as a digital assistant that reads your invoices for you - whether they're PDFs or even just photos of a document - and instantly pulls out the important bits like vendor names, invoice dates, and total amounts. No more typing.

The market for this tech is absolutely exploding, and for good reason. The global invoice processing software market was valued at $33.59 billion in 2024 and is on track to hit $40.82 billion in 2025. This massive growth is all about businesses finally ditching paper and embracing digital OCR systems. You can dig into the full invoice processing software market report if you're curious about the trends driving this shift.

This chart really puts the growth of the invoice processing software market into perspective.

The data speaks for itself. Businesses are clearly moving fast to automate how they handle their accounts payable, and for good reason.

Selecting the Right Tool for Your Business

Finding the "perfect" tool really comes down to your business - its size, its complexity, and the software you already use. You don't need to dive into a massive, enterprise-level system right off the bat. The goal is to find something that solves your problems now but gives you room to grow later.

Here’s a quick rundown of the kinds of tools you'll find out there:

- •Simple Invoice Scanners: These are often mobile apps or basic desktop programs that do one thing really well: use OCR to turn paper invoices into digital data. They're a fantastic first step away from pure manual entry.

- •Dedicated Invoice Management Platforms: This is where tools like Tailride shine. They act as a central hub for all your incoming bills. They can pull invoices right from your email, use smart AI to extract and categorize the data, and plug directly into your other business software. You can learn more about these powerful systems in our guide to invoice automation software.

- •All-in-One Accounting Software: Many platforms you might already be using, like QuickBooks or Xero, have their own invoice processing features built-in. This can be a great option if you love the idea of keeping your bookkeeping, payments, and invoice management all under one roof.

My Two Cents: The single most important thing to look for is seamless integration. Your chosen tool absolutely must talk to your accounting software and bank accounts without any fuss. Otherwise, you’re just creating more work for yourself.

Features That Are Non-Negotiable

As you start comparing your options, focus on the features that will actually make a difference in your day-to-day. Before you can get the most out of these platforms, it helps to understand how to automate invoice processing to save time and slash errors.

From my experience, here are the must-haves:

- •Automated Data Capture: The software needs to reliably pull data from all sorts of formats - PDFs, JPEGs, and even the body of an email.

- •Workflow Automation Rules: This is a total game-changer. Being able to set up rules - like automatically tagging all invoices from "Vendor X" or flagging anything over $1,000 for review - is what true automation is all about.

- •Direct Software Integrations: Make sure the tool has native, pre-built connections to your accounting platform (like Xero or QuickBooks) and cloud storage (like Google Drive). This prevents you from creating isolated piles of data that don't talk to each other.

Picking the right tools is a foundational step in modernizing how you handle invoices. Making that leap from manual to automated isn’t just about efficiency; it's about setting your business up to scale, improving your accuracy, and getting your valuable time back.

Creating Your Invoice Processing Workflow

Your digital folders and automation tools are fantastic, but they’re just the building blocks. The real secret to taming invoice chaos lies in creating a consistent, reliable process that shepherds every bill from arrival to archive. This is how you truly organize invoices for the long haul, transforming a frantic paper chase into predictable, calm order.

Let's walk through how to build a routine that works for you. This isn't about setting rigid, unbreakable rules. It's about creating a smooth, clear path for every invoice so that absolutely nothing gets missed. A solid workflow prevents late fees, stops you from paying the same bill twice, and gives you a crystal-clear picture of your company's financial commitments at any given moment.

The Four Stages of an Invoice’s Journey

I find it helps to think of an invoice's life in four distinct stages: Capture, Verify, Approve, and Pay & Archive. Each phase has a straightforward goal and a few simple actions. Once you get these down, you'll have a system that practically runs on its own.

First, Capture Everything in One Place

Your first move is to create a single funnel for every single invoice that comes your way. My go-to pro tip? Set up a dedicated email address just for bills. Something like ap@yourcompany.com or bills@yourbusiness.name works perfectly. Then, instruct all your vendors to send their invoices there.

This one simple change immediately stops bills from getting buried in your personal inbox or scattered across your team's emails. What about the occasional paper invoice that still shows up? The rule is simple: scan it the second it arrives and email the digital file to that same dedicated inbox.

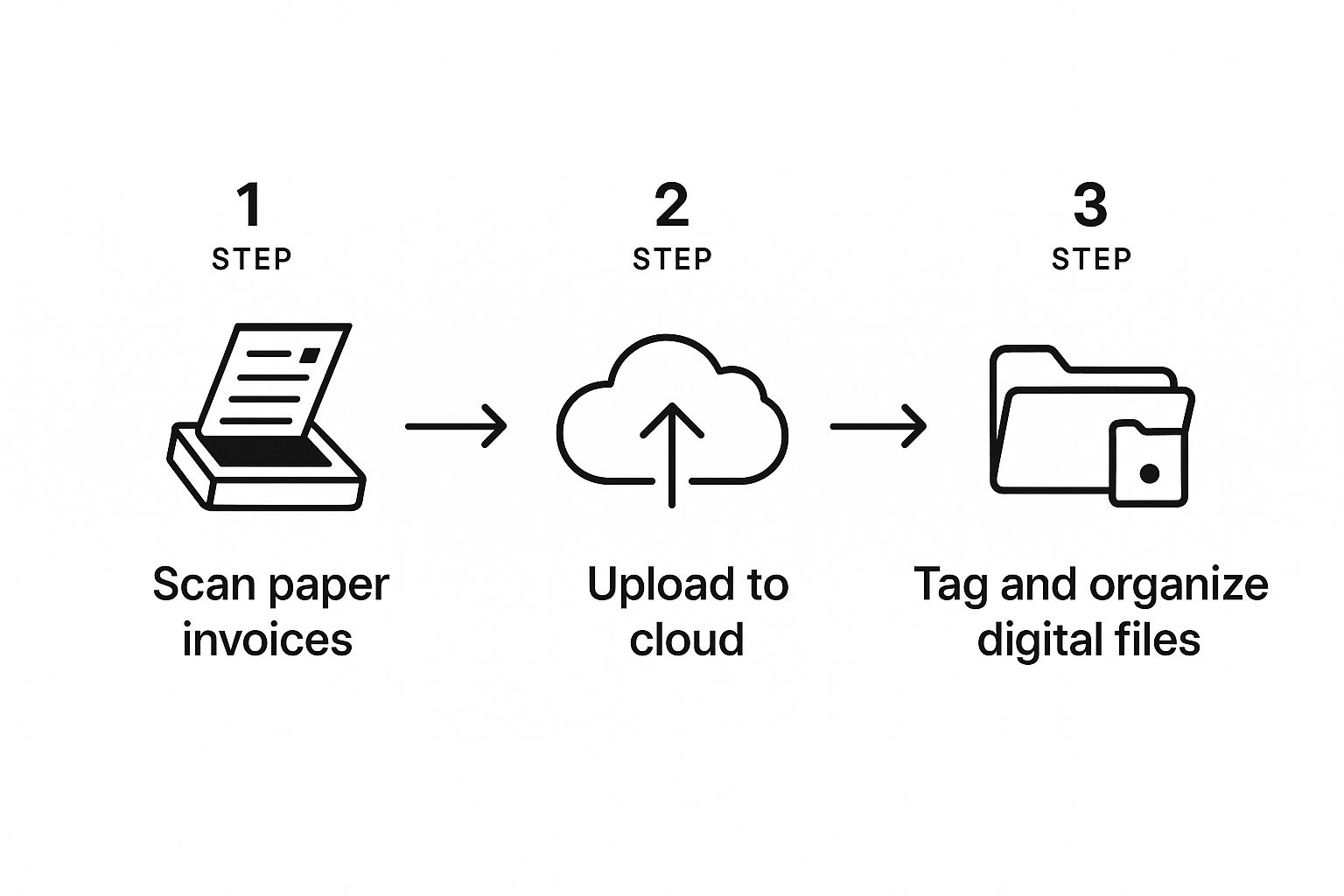

This diagram lays out a great visual for getting those physical stragglers into your digital system.

It’s a great reminder of the essential first step in any modern workflow - making sure every document, no matter its origin, ends up in one digital hub.

Next, Verify and Extract the Data

Once an invoice lands in your central hub, it's time for a quick check. This is your verification step, where you confirm all the details are accurate. Does the vendor name look right? What about the invoice number, the amounts, and the due date?

If you're using a tool like Tailride, this is where the magic happens, as its AI will pull out this key information for you automatically. Manually typing data is not only slow but also a recipe for typos. Learning a few tricks can make a huge difference, and this practical guide on how to extract data from PDFs is a great resource, since most invoices arrive in that format.

Then, Streamline Your Approvals

Let's be realistic - not every invoice can be paid on the spot. Larger bills or unusual expenses often need a manager's sign-off. Your workflow needs a clear plan for this.

- •Set a simple approval threshold. For example, you might decide all invoices over $500 need a manager's review.

- •Automate the notification. Use your software to automatically flag these invoices and ping the right person for approval.

- •Use clear status tags. A tag like "Pending Approval" tells everyone on your team exactly where that bill is in the process.

This adds a crucial layer of financial control and helps prevent unauthorized spending without creating a bottleneck.

Finally, Schedule Payments and Archive Securely

With the green light for payment, the invoice enters its final stage. The key here is to schedule the payment, not necessarily pay it immediately. This lets you hold onto your cash as long as possible, which is great for cash flow. The only exception is if there’s a sweet discount for paying early.

Once you've sent the payment, the last step is to drag that invoice into your "Paid" folder. Be sure to tag it with the payment date and the method used. This closes the loop perfectly, leaving you with a clean, audit-ready digital trail.

Following these steps will shift your invoice management from a reactive scramble to a proactive, orderly system. If you're looking to go even deeper, our guide on how to keep track of invoices is packed with even more strategies to help you master your financial paperwork.

Making Your Financial Reports Actually Work for You

All this work organizing your invoices isn't just about having a tidy digital filing cabinet. It’s about turning that organized data into real, actionable financial intelligence. This is the moment where your daily efforts pay off, giving you a clear view of your business's health.

The most critical habit you can build is regular reconciliation. I can't stress this enough. At least once a month, you need to sit down and match your invoice records against your bank and credit card statements. Think of it as your first line of defense against costly mistakes.

This simple check helps you instantly catch things like duplicate payments, incorrect charges, or even missed vendor payments that could sour a good relationship. Trust me, finding a $500 double-charge a week after it happens is an easy fix. Finding it six months down the road? That's a whole different level of headache.

Your Invoice Reconciliation Checklist

To make this process foolproof, I've put together a quick checklist. Running through these steps every month will keep your books clean and your mind at ease.

| Checklist Item | Purpose |

|---|---|

| Gather All Invoices | Ensure you have every invoice for the period you're reviewing. |

| Pull Bank/Credit Statements | Download the corresponding transaction statements from your bank. |

| Match Invoice to Payment | Systematically check off each paid invoice against a transaction line item. |

| Investigate Discrepancies | Flag any unmatched transactions or invoices for immediate follow-up. |

| Confirm All Payments are Recorded | Make sure every payment leaving your account is tied to a legitimate invoice. |

| Verify Amounts | Double-check that the amount paid matches the amount on the invoice exactly. |

Following this checklist transforms reconciliation from a chore into a powerful financial management tool, ensuring nothing ever slips through the cracks.

From Clean Data to Smart Decisions

Once your invoice data is clean and reconciled, you can stop just bookkeeping and start generating truly powerful financial reports. These reports are your command center for understanding where your money is going and making smarter decisions about cash flow.

One of the most valuable reports you can pull is an accounts payable (AP) aging report. This document gives you a crystal-clear snapshot of who you owe, how much you owe, and when it’s all due. It’s usually broken down into simple time-based categories:

- •Current: Invoices due within 30 days.

- •31-60 Days: Bills that are a little behind schedule.

- •61-90 Days: These need your immediate attention.

- •90+ Days: Critical debts that could damage your credit or business relationships.

Running this report regularly helps you prioritize payments, manage your cash effectively, and even snag early payment discounts. The whole thing becomes so much easier with the right tools, and learning about invoice processing automation shows you how tech can generate these reports for you with just a few clicks.

Don't Forget to Archive for Audits and Compliance

After an invoice is paid and reconciled, its job isn't quite done. The final, non-negotiable step is to archive it properly. This isn't just about being neat - it's a critical part of staying compliant.

The gold standard for tax and audit purposes is to keep all business invoices and financial records for at least seven years. This gives you a safe buffer for any questions that might come from tax authorities.

Digital archiving makes this a breeze. Your organized folders and consistent naming conventions have already created an audit-ready trail for every single transaction. If you ever need to find an invoice from five years ago, this system lets you pull it up in seconds, not hours. It's the final piece of the puzzle that secures your records and turns all your hard work into lasting business intelligence.

Common Questions About Organizing Invoices

Even with the best system, a few questions always seem to pop up once you start getting your invoices in order. Let's walk through some of the most common ones I hear from business owners and finance teams. Nailing these down will help smooth out any wrinkles in your process so you can move forward with confidence.

One of the first things people ask is what to do with all the old paperwork. It's tempting to think you need to digitize every single document from the last decade right away, but that's a recipe for burnout. My advice? Focus on your new digital system for all incoming invoices first. Once that habit is second nature, you can circle back and chip away at those old filing cabinets.

How Long Should I Keep Paid Invoices?

This is a big one, touching on both legal compliance and just plain old clutter. The standard I always recommend is to keep all business records, including paid invoices, for a minimum of seven years.

Why seven years? It gives you a comfortable buffer for most tax authorities in case you ever face an audit. This is where digital archiving is a lifesaver - it’s infinitely easier and more secure than keeping boxes of paper that can get lost, damaged, or faded over time.

What Is the Best Way to Handle Paper Invoices?

My rule is simple: go digital the moment it lands on your desk. When a paper invoice comes in, immediately use a good office scanner or a trustworthy mobile scanning app (like Adobe Scan or even the one built into your phone's Notes app) to create a crisp, clear PDF.

Once you’ve double-checked that the digital copy is perfectly legible and saved in your central system - say, in that "Pending" folder we talked about - you can shred the original. This one habit completely changes the game. No more piles of paper, and no more lost documents.

The goal is to make the physical paper's lifespan in your office as short as possible. Scan it, save it, and shred it. This simple "capture and release" workflow keeps your desk clean and your digital files complete.

Should I Use Cloud Storage or Dedicated Software?

When you're just getting started, basic cloud storage from providers like Google Drive or Dropbox is a perfectly fine place to begin. It's a huge step up from a physical filing cabinet. But as your business grows, you'll quickly start to feel the pain points of a simple folder system. It just doesn't scale well.

This is where dedicated invoice management software really shines. It's built specifically for this job and brings some serious advantages to the table:

- •No More Manual Data Entry: Tools with OCR technology can read the invoice for you, pulling out key details like the vendor, date, and amount. This alone saves a staggering amount of time.

- •Smarter Workflows: You can create rules for approvals, automatically categorize expenses, and set up payment reminders.

- •Seamless Connections: They're designed to talk directly to your accounting software and bank accounts, which means your whole financial picture stays in sync without you lifting a finger.

So while cloud storage is a great start, think of dedicated software as the next level. It takes you from simply storing documents to actively managing your financial workflow with smart, automated tools.

Ready to stop chasing down invoices and start automating your workflow? Tailride connects directly to your email and online portals, using AI to capture, categorize, and organize every bill for you. See how much time you can save with Tailride.